2018 Top States and Districts

Today, the American Investment Council (AIC) released its annual Top States and Districts Report, which ranks the diverse communities across the country that received the most private equity…

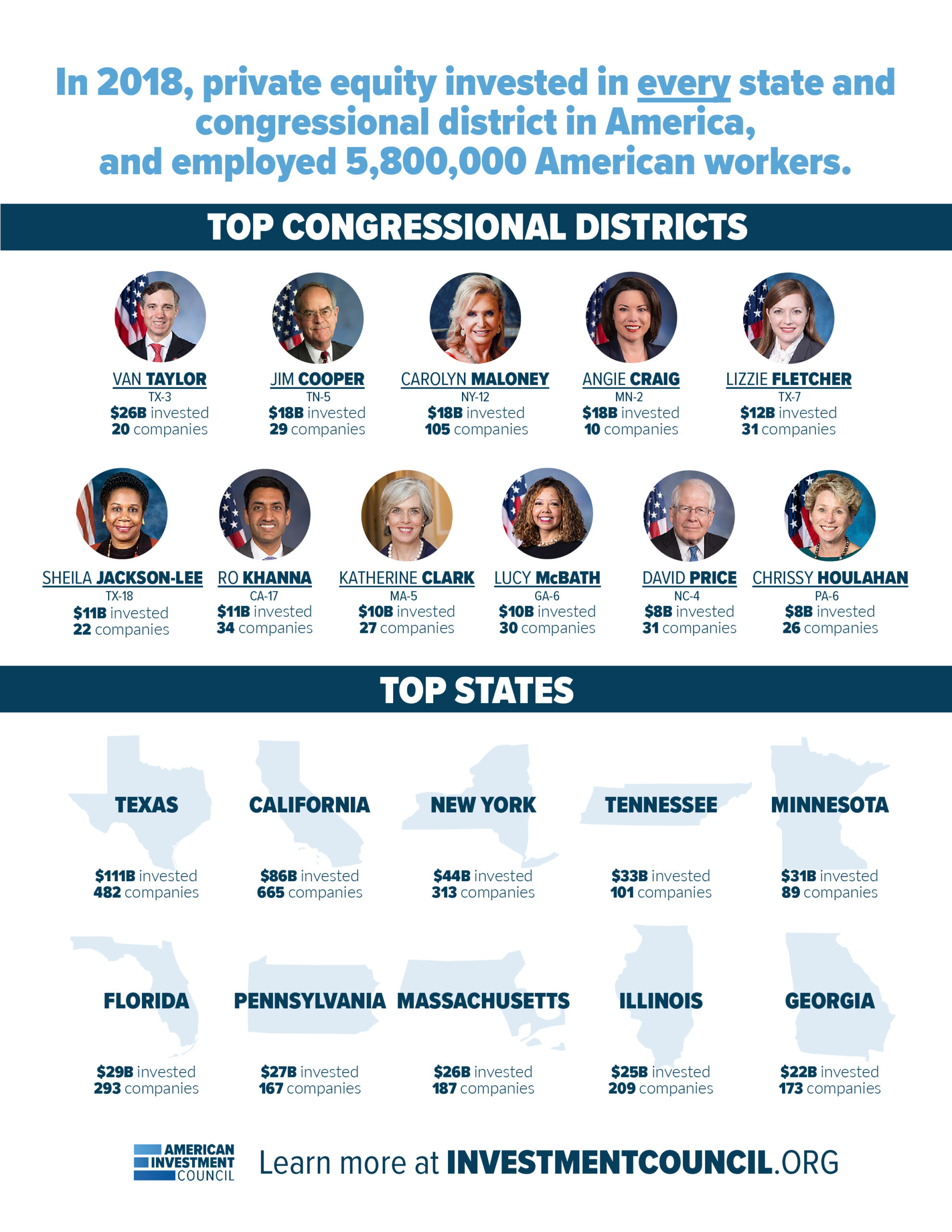

Today, the American Investment Council (AIC) released its annual Top States and Districts Report, which ranks the diverse communities across the country that received the most private equity investment. Texas took the top spot, with private equity investing $111 billion in 482 Texas-based businesses in 2018 alone. California followed in a close second, with 665 Golden State businesses receiving $86 billion in private equity investment. New York ($44 billion), Tennessee ($33 billion) and Minnesota ($31 billion) finished out the top 5.

“Our Top States and District report confirms that thousands of small businesses and millions of American workers depend on private equity investment,” said AIC President and CEO Drew Maloney. “Private equity supports entrepreneurship, builds industry expertise, and creates lasting growth for local communities across the country.”

The Congressional districts that received the most investment included:

- Texas 3 (Rep. Van Taylor) – $26 billion

- Tennessee 5 (Rep. Jim Cooper) – $18 billion

- New York 12 (Rep. Carolyn Maloney) – $18 billion

There are currently 5.8 million Americans who are employed by 35,000 private equity-backed businesses. Between 2013-18, private equity invested an estimated $3.4 trillion to help these American businesses grow.

“Private equity firms are a crucial partner for small and large businesses that need capital to expand and hire new workers,” said AIC Director of Research Jamal Hagler. “Private equity also provides invaluable industry expertise that helps businesses improve their performance and add long-term value.”

There are more than 5,000 U.S. private equity firms making investments in all 50 states on behalf of institutional investors including public pension funds, college endowments, and nonprofits.

Read a summary of the report here.