Robust Activity Makes 2015 A Banner Year In Private Equity

WASHINGTON – The Private Equity Growth Capital Council (PEGCC) released its 2015 Q4 trends report today, providing an overview of industry activity for the quarter, as well as throughout 2015. Of…

WASHINGTON – The Private Equity Growth Capital Council (PEGCC) released its 2015 Q4 trends report today, providing an overview of industry activity for the quarter, as well as throughout 2015. Of particular note, exit volume increased from $302 billion in 2014 to $357 billion in 2015, marking the highest quarterly exit volume ever. Investment levels remained relatively unchanged from 2014, with $632 billion invested by U.S. private equity last year. Fundraising amounts increased to $181 billion in 2015, a one percent rise compared to 2014.

“This report affirms the U.S. private equity industry is strong and only growing stronger,” said recently appointed PEGCC President and CEO Mike Sommers. “U.S. private equity firms invested over $630 billion and finalized 3,500 deals last year. We expect this positive momentum to carry on in 2016.”

Bronwyn Bailey, PEGCC Vice President of Research, pointed to the various trends within the report as a sign of good things to come for the industry.

“The noticeable trends in the Q4 report indicate the private equity industry is on sound footing,” said Bailey. “While overall investments remained steady, private equity firms increased the amount of capital raised in 2015, particularly in Q4, when capital raised increased by almost 75 percent compared to Q3. Combine this with the increase in exit volume seen in 2015, and there’s a lot to be excited about for private equity in the near future.”

Below are five key findings from the report. Read the full report here.

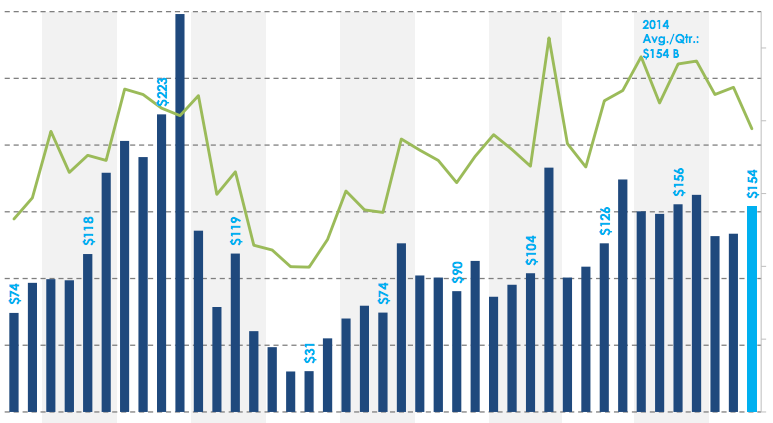

- U.S. PE Investment Volume Holds: Annual U.S. private equity investment volume experienced a minimal drop from $634 billion in 2014 to $632 billion in 2015.

- Equity Contributions Increase: Total equity financing for U.S. leveraged buyouts increased to 42 percent in 2015.

- U.S. Fundraising Rises Slightly: Annual U.S. private equity fundraising volume rose from $179 billion in 2014 to $181 billion in 2015.

- Dry Powder Grows: Callable capital reserves (“dry powder”) of global buyout funds rose from $448 billion in December 2014 to $460 billion in December 2015.

- Exit Volume Rises: Annual U.S. private equity exit volume increased from $302 billion in 2014 to $357 billion in 2015.