New EY Report Shows Private Equity Strengthens U.S. Economy with More Jobs, Higher Pay, and Increased Investment

Includes State by State data on PE-backed jobs, companies, investment

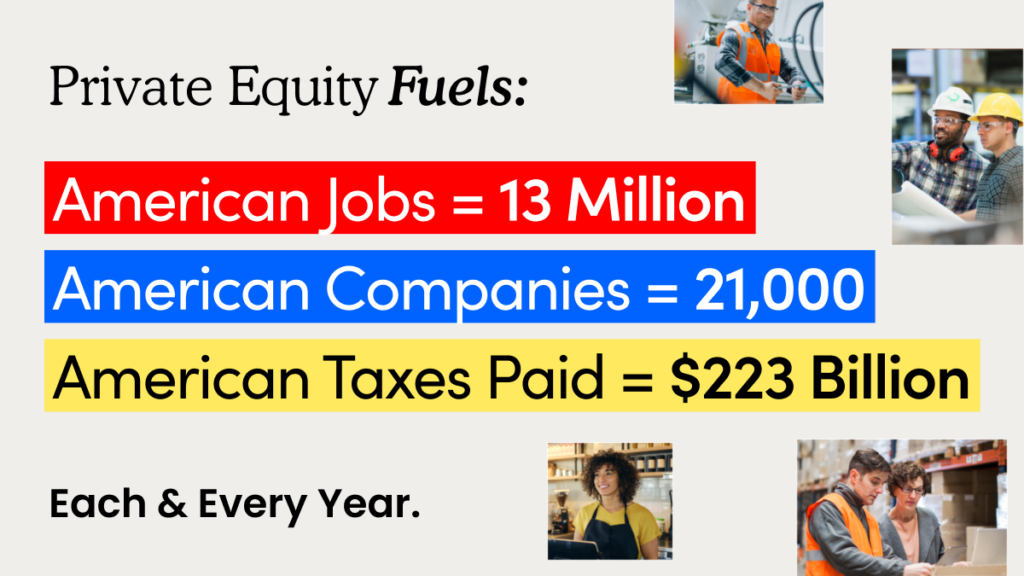

WASHINGTON, D.C. – Private equity continues to play a crucial role in building the U.S. economy, fostering business growth, creating jobs, and strengthening industries across the country, according to the latest edition of a report released by the American Investment Council and Ernst & Young LLP (EY). The report provides new data on the national impact of private equity investments, as well as detailed statistics for all 50 states on jobs, wages and benefits, and GDP. Nationally, private equity directly employed 13.3 million workers, up from 12 million in 2022. Workers at private equity-backed businesses also earned an average of $85,000 in wages and benefits in 2024, a roughly 6 percent increase from 2022. In total, the private equity sector contributed $2 trillion to gross domestic product (GDP) in 2024 and now represents approximately 7 percent of total U.S. GDP.

“The numbers in this report tell a clear story: Private equity is an engine of opportunity in America,” AIC President and CEO Drew Maloney said. “We are invested in the success of communities across the country. Whether helping small businesses grow, paying workers competitive wages, or strengthening entire industries, private equity is making a real difference in people’s lives.”

The study outlines private equity’s contributions to the overall U.S. economy, including the following benefits:

- Employs Millions Of Workers – The private equity industry directly employed 13.3 million workers in 2024, an increase from 12 million in 2022.

- Supports Small Businesses – In 2024, the median private equity-backed business employed just 72 workers. Approximately 85% of PE-backed businesses were small businesses that employed fewer than 500 workers.

- Pays High Wages – The average worker at private equity-backed businesses earned $85,000 in wages and benefits in 2024, a 6 percent increase from 2022.

- Fuels Economic Growth – Private equity investments generated $2 trillion of gross domestic product (GDP), an increase from $1.7 trillion in 2020. These investments amounted to approximately 7 percent of total U.S. GDP.

- Generates Significant Tax Revenue – Private equity contributed $337 billion in federal, state, and local taxes. Approximately two-thirds were federal taxes ($223 billion), with the remainder paid to state and local governments ($114 billion). These tax contributions amount to about 5 percent of all federal tax revenue, as well as 5 percent of all state and local tax revenue.

- Multiplies Economic Impact Nationwide – Private equity’s suppliers and related consumer spending supported an additional 20.1 million workers and added $2.7 trillion to U.S. GDP in 2024.

The report estimates the current economic activity of, and related to, the U.S. private equity sector – including U.S. private equity firms and private equity-backed companies – within the US economy in 2024. The American Investment Council and EY last released this report in 2023, which examined private equity’s contributions to the U.S. economy for the year of 2022.