New Study: Private Equity Delivers the Strongest Returns for Millions of Public Servants

Maloney: “Strong private equity returns ensure that tens of millions of dedicated public servants can depend on a well-funded pension to support their well-deserved retirement.”

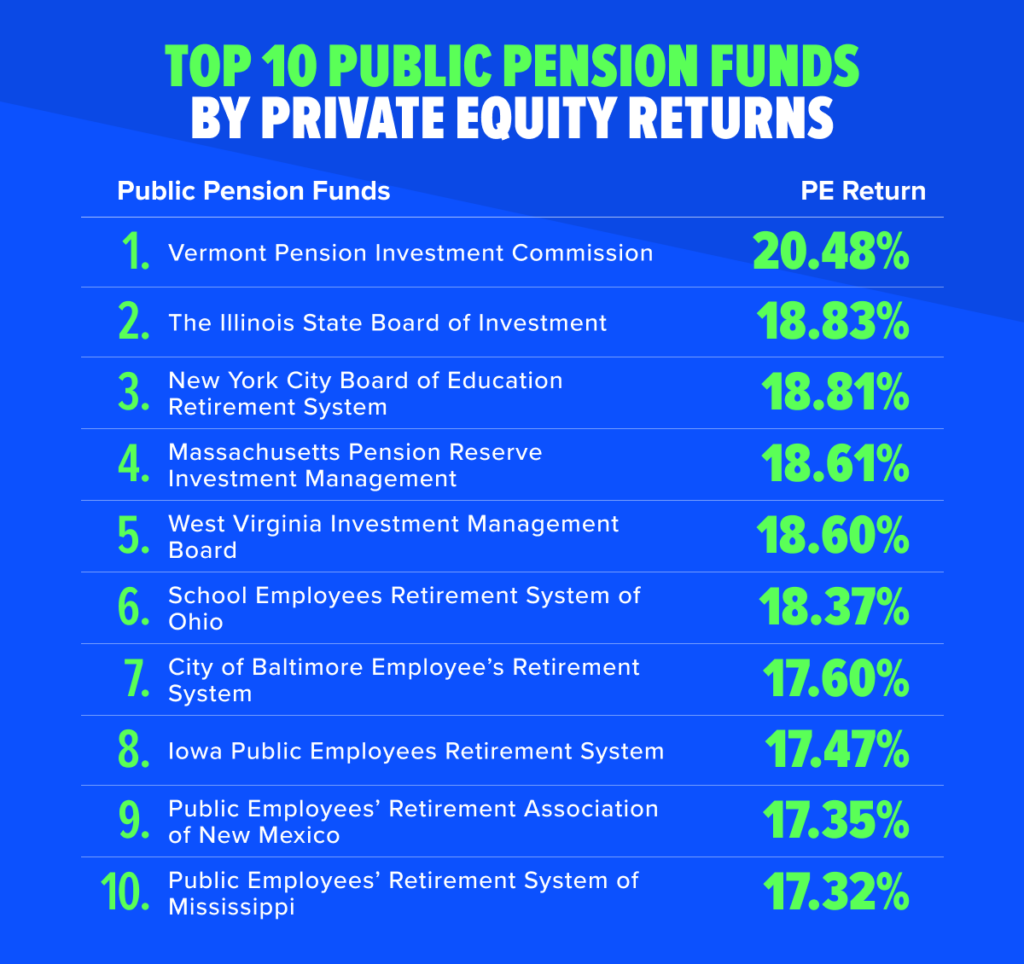

Washington, D.C. – Today, the American Investment Council released its 2024 public pension study showing that private equity once again delivered the strongest returns for public pension portfolios. In 2023, private equity investments delivered a median annualized return of 15.2 percent over a 10-year period. Every year since 2012, our study has found that private equity is the best-returning asset class in public pension portfolios, outperforming all other asset classes.

“Private equity is a critical component of almost every public pension plan in the U.S., consistently delivering outsized returns and providing options for diversification during times of economic turmoil,” said AIC President and CEO Drew Maloney. “Pensions are a promise to first-responders, public school teachers, and every dedicated public servant who gives back to their communities. Strong private equity returns ensure that tens of millions of dedicated public servants can depend on a well-funded pension to support their well-deserved retirement. Our investments also support thousands of small businesses and drive innovation across our country.”

AIC’s findings back up independent studies showing the value of private equity to public pension funds. A study published by Cambridge Associates found that over the last decade, “institutions with higher private investment allocations experienced higher returns historically. And, those returns tended to be less volatile.”

The study analyzed 200 U.S public pension funds representing nearly 34 million public sector workers and retirees.

By The Numbers

- 15.2% – The private equity median annualized return over a 10-year period, higher than all other asset classes including public equity, real estate, and fixed income.

- 34 Million – The number of U.S. public sector workers who depend on private equity to secure their retirements.

- 88% – The share of public pension funds nationwide that invest a portion of their portfolio in private equity.

- 14% – The private equity make up of public pension portfolios on a dollar weighted basis.

What Public Pension Funds Are Saying about Private Equity

Below are direct quotes from public pension fund chief investment officers and executive directors about why they chose to invest in private equity:

Eric Henry, Chief Investment Office, Vermont Pension Investment Commission

- “I am extremely proud of our results and my team, whose tireless efforts produced our strong track record. Our successful private market investment program would not have been possible without their leadership and diligence. The endless support of our commissioners, who have challenged us to build out our program and bring them compelling investment opportunities, has put the VPIC portfolio in a very strong position.”

Dipesh Mehta, Executive Director & Chief Investment Officer, Illinois State Board of Investment

- “ISBI is proud to be recognized once again as a national leader in private equity performance. Our consistent, strong performance is thanks to our innovative investment model, thoughtfully controlled fees, and our dedicated team and excellent partners, who work diligently to achieve these top-tier results on behalf of over 174,000 beneficiaries. ISBI will continue to strive for investment excellence on behalf of all those we serve.”

Michael Trotsky, Chief Investment Officer of the Massachusetts Pension Reserves Investment Management Board

- “We are pleased that AIC’s research has determined that MassPRIM’s private equity portfolio is one of the highest performing in the country over a long period of time. The PRIM team has a relentless focus on securing high-quality investments, and the rank of 4 out of 200 reflects the team’s deep industry knowledge along with its rigorous selection and monitoring processes. These traits have driven the industry-leading, long-term returns that are essential to secure retirement benefits for more than 300,000 current and future retirees in our state.”

Jim Herrington, Private Equity Investment Officer, West Virginia Investment Management Board

- “We plan to continue to invest in the Private Equity asset class and have actually increased our allocation percentage for existing participant plans. In addition, more participant plans that we oversee have opted in over the last few years.”

Farouki Majeed, Chief Investment Officer, School Employees Retirement System of Ohio

- “Achieving success in our private equity portfolio, which ranks among the best in the nation, is proof positive of our investment staff’s ability to identify and evaluate top performing managers. Over the last 10 years, SERS’ private equity portfolio has realized a net gain of nearly $2.5 billion, which has significantly contributed to the retirement security of our active and retired members. Maintaining a sustainable pension fund is a priority that largely hinges on the success of our investment portfolio and the excess returns generated by our private equity portfolio are a significant part of that success.”

LeAnne Larrañaga-Ruffy, Deputy Chief Investment Officer, Public Employees Retirement Association

- “New Mexico PERA is proud to be recognized by the AIC for achieving the #9 ranked private equity returns over the 10-year period ending June 30, 2023. This accomplishment is a testament to the dedication and expertise of NMPERA staff and selection consultants, whose consistent strategy and hard work have driven our strong performance. These efforts help ensure we fulfill our mission to provide stable retirement benefits to current and future public employees of New Mexico.”

To learn more, read the full 2024 Public Pension Study.