Stronger with Private Equity

The private equity industry invests in every Congressional district across America – directly backing over 12 million jobs and supporting thousands of small businesses. As Congress considers changes to the tax code, learn how private investment fuels manufacturing, drives innovation, strengthens supply chains, and is helping to build the new economy. Whether you live on Main Street or in Rural America, private equity is investing in your local community.

Manufacturing

Private equity has invested more than $1.4 trillion in more than 11,000 manufacturing businesses over the past decade in every state of the country. Since 2012, almost 1,500 manufacturers across Texas, Oklahoma, Louisiana, and Arkansas, have received private equity investments, with capital infusions totaling more than $200 billion. In the Great Lakes region, more than 2,700 manufacturers have partnered with private equity, with more than $420 billion being invested in them combined. In the Mid-Atlantic region, more than 1,700 manufacturers have benefited from private equity investments totaling $225 billion. Click here to read out report on how private equity makes manufacturing stronger.

Small Businesses on Main Street

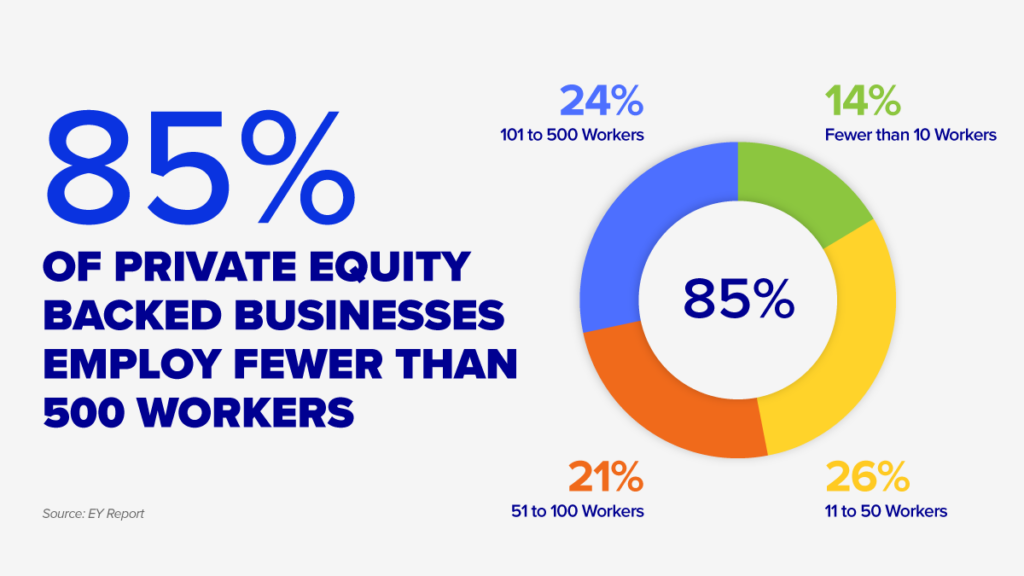

In 2022, private equity invested in companies with a median workforce of just 69 employees, and approximately 85 percent of private equity-backed businesses were small businesses with less than 500 employees.

Private equity has also increasingly invested in “carveouts,” namely under-loved, under-resourced, or misaligned business units within larger companies. In 2021, private equity firms invested over $119 billion to carveout nearly 600 new, standalone companies — a 52 percent increase from 2020. Over the past decade, private equity firms have invested over $700 billion and carved out over 4,000 new, standalone companies.

Rural America

Private equity investments have enabled critical health care providers to scale and expand into rural and underserved neighborhoods across the country. In 2014, prior to partnering with private equity, GoHealth Urgent Care had zero care centers. However, through private equity investment, the organization has since expanded to more than 200 care centers nationwide, providing care both virtually and in person. GoHealth represents one of many successful private equity partnerships that empower organizations to scale and expand to numerous locations without compromising quality.

Supply Chains

The AIC’s annual Top States & Districts report, which ranks the country’s top twenty states and Congressional districts by total private equity capital and the number of companies receiving investment in 2022, found that commercial services—such as manufacturing and logistics—and information technology attracted more than half of US private equity investment in 2022.

Innovation

Private equity has invested more than $108 million in U.S. health care throughout 2022 – representing 11.1 percent of private equity investment. In the life sciences industry, private credit provides capital for companies developing innovative and lifesaving treatments. This critical capital helps improve virtual and digital care, fund research and more effective treatments, expand and renovate facilities, modernize medical records and health care data, and make other needed investments to improve patient care across America.

Anthos Therapeutics, a biopharmaceutical company based in Massachusetts, partnered with private equity and has been able to develop a new treatment to significantly reduce the risk of blood clots. Backed by AIC member Blackstone Life Sciences, the treatment could provide a safer alternative for the 12.1 million Americans expected to suffer from atrial fibrillation by 2030.